The media has been much abuzz over the release, via a Freedom of Information Act request from the Competitive Enterprise Institute, of a March, 2009 analysis of cap-and-trade legislation by the US Treasury Department that purportedly said the cost of such a law would be some $200 billion in taxes – and raise the tax burden on each household by as much as 15% on average.

Beyond the initial furor, however, it appears those numbers, while accurate in a sense, may not be worth the hubbub quite yet.

The Treasury analysis did include figures saying a cap-and-trade law could cause the average household to pay as much as $1,761.00 per year in taxes, directly or indirectly, and that the net new taxes would, in effect, raise the total US tax burden by some 15%. This was the headline news and, if true, would likely add to fears of the impact of cap-and-trade legislation on the economy and tax payers. "The reporting on the Treasury analysis is flat out wrong," said Alan Krueger, Treasury assistant secretary for economic policy. "Treasury's analysis is consistent with public analyses, and the reporting and blogging on this issue ignores the fact that the revenue raised from emission permits would be returned to consumers under both administration and legislative proposals."

However, today both the Treasury Dept. and various environmental groups pushed back, for example, by noting that the analysis was generic and before the current Waxman-Market bill was introduced and passed in the House of Representatives. It appears that under that bill, as many have recommended, the auctioning of CO2 permits under cap and trade would be “revenue neutral,” with some sort of plan to give any proceeds back to taxpayers through reduced taxes elsewhere (such as payroll taxes) or rebates.

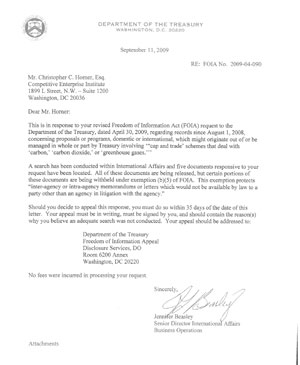

That may be, but the memo is still intriguing. It is available for download from TheGreenSupplyChain.com here: US Treasury Analysis of Cap and Trade Costs.

Interestingly, for example, in the first paragraph the Treasury analysis says that “While such a program can yield environmental benefits that justify its costs, it will raise energy prices and impose annual costs on the order of….” – with those figures blacked out under a “B5” exemption under the Freedom of Information Act. Why Treasury would find the need to do that is not clear.

The report then immediately notes that the government might collect revenues of $100-$200 billion annually from selling CO2 permits. Those estimates might differ from the annual cost estimate (blacked out) because once the permits are sold, their actual pricing would be determined in the free market under cap and trade – and if the permits are sold at a relatively low cost initially, as is likely, then the real cost to business and consumers could be much higher as the permits trade.

The report also notes that the economic impact of cap and trade is highly speculative: “GDP loss estimates in 2050 from implementation of the Leiberman-Warner bill [a proposed Senate bill for cap and trade] vary by a factor of four depending on the model.” The report also notes that the economic impact of cap and trade is highly speculative: “GDP loss estimates in 2050 from implementation of the Leiberman-Warner bill [a proposed Senate bill for cap and trade] vary by a factor of four depending on the model.”

It also notes the complexity of implementing a cap-and-trade system: “Creation of a domestic cap and trade system would require management and oversight consistent with, if not stronger, than existing markets for commodities and government securities.”

The document is definitely worth a read whatever side of the debate you are on.

What is your reaction to the Treasury Dept. analysis? Do we understand the economics of all this well enough yet to impose a cap-and-trade regime in the US? Let us know your thoughts at the Feedback button below.

TheGreenSupplyChain.com is now Twittering! Follow us at www.twitter.com/greenscm

|