The following article is an excerpt from Supply Chain Digest’s recent SCD Letter on The Green Supply Chain. To download an e-version of the full letter, go here: SCDigest Letter on the Green Supply Chain.

One big elephant in the room when it comes to carbon emissions is the challenge companies will have calculating, monitoring and tracking CO2 emissions internally and across their trading partners.

Obviously, today’s accounting principles, let alone software, were not designed with CO2 emissions tracking in mind. As a result, carbon emissions data from almost any company or supply chain right now should probably be taken with a grain of salt, if not a large helping.

Clearly, there are technical and process challenges in accurately collecting the data, including some fairly basic questions about what should really be counted where. Next will be even tougher questions about how to allocate, for instance, a company’s share of the carbon emissions from its use of less-than-truckload (LTL) carriers, and if or how you need to track CO2 data from your supplier’s supplier.

In addition, the reality is that currently, companies generally have some incentive to over-state their current levels of carbon emissions, when the stakes are low, so as to be able to show marked improvement later when Wal-Mart, HP or the government comes asking again in the future. Make yourself look like a carbon hog right now, and tremendous gains in percentage improvements will be easy later on.

Software Vendors Beginning to Offer Tools

As Green supply chain thinking gained momentum over the past few years, a slew of vendors have announced “carbon calculators” of some kind or another. Some were more marketing exercise than serious product, but slowly real tools are coming to be made available. As one example, a few supply chain network design/ optimization software vendors have started to explicitly incorporate the carbon emissions that will result from different network design strategies – clearly a critical consideration if cap and trade type legislation is eventually passed.

At the network design level, companies should be able to manage with a fairly general estimate of the emissions profiles for different modes of transport, facility types and locations (for example, is a potential location for a given distribution center in an area that is served by a coal-fired electric plant or a nuclear one?).

But even here, similar types of scenario analysis will be required. Companies will have to plan using various levels of carbon emission costs in the future, just as they have been doing recently based on different scenarios for the cost of fuel.

In terms of detailed reporting and potential cap and trade impacts, however, measurement will need to get more precise – and as usual, the use of manual tools will only take a company so far.

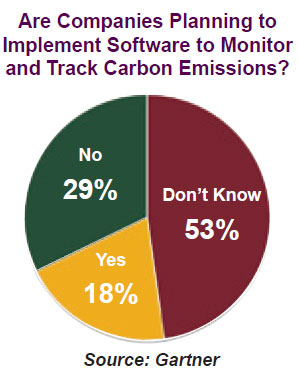

The researchers at Gartner, for example, said in a recent report that they recommend all medium and large companies “start building processes and systems to gather carbon emissions data from their global operations and consider introducing a shadow carbon price for assessing all new projects.” Gartner adds that “calculating emissions is challenging, and enterprises need to be able to provide evidence and traceability of any improvements they’ve made if such performance improvements are to be counted in their favor.” As shown in the graphic above, relatively few US companies (18.4%) have current plans to implement focused carbon emissions tracking solutions. But tracking emissions in spreadsheets will soon prove overwhelming. “It is only a matter of time before companies will have to report carbon emissions,” says Gartner’s Simon Mingay. “Our advice is to start now, save a lot of time and hassle, and do it properly and well.”

Consider the hundreds, thousands, or tens of thousands of products and components many companies handle. Some may be made internally, others sourced, sometimes from other manufacturers, sometimes from distributors – each SKU with its own “carbon footprint” that may need to be tracked. It will literally be like having to maintain a second set of books. Consider the hundreds, thousands, or tens of thousands of products and components many companies handle. Some may be made internally, others sourced, sometimes from other manufacturers, sometimes from distributors – each SKU with its own “carbon footprint” that may need to be tracked. It will literally be like having to maintain a second set of books.

The reality is that it is going to require a complicated web of actual calculation, estimates, and acceptance of the reporting of trading partners, who in turn will be dealing with their own set of similar issues. There are some sources that can help. The Carbon Disclosure Project offers templates and data collection services for companies to measure their own and their suppliers’ carbon emissions.

A few software solutions are starting to develop their own “emissions factors” for a wide range of products and components – in other words, a ton of stainless steel would be pre-assigned a given emissions level. While it seems such aggregation is inevitable, obviously the use of these types of averages could penalize a company that procures or makes products more carbon efficiently. We also expect to see more “point” solutions that can be rolled up to help determine corporate numbers. In other words, it might be relatively easy for a TMS vendor to ultimately be able to very accurately calculate CO2 for transportation moves – but the TMS won’t help much in what manufacturing is doing, which will have its own systems. All of this CO2 from different applications will be fed to a “CO2 data warehouse” or something similar. That in turn means that companies evaluating almost any new piece of supply chain software should be asking the vendors about their capabilities and plans for carbon tracking.

Supplier Reporting

Supplier CO2 and Green performance management is also likely to be increasingly important. “Green-ness” already is part of the vendor scorecard for many suppliers at Wal-Mart, and many other retailers, wholesalers, and manufacturers are likely to follow suit.

Such Green scorecards are likely to have two components: (1) a more qualitative element, that may give a vendor a score based on the perceived progress it is making on say reducing product packaging; (2) quantitative measures, such as how efficient a supplier is in transportation management. In total, it is certain that the growing power of “supply chain performance management” will need to take on a new and very Green aspect as well over the next few years.

Do you have any experience with CO2 emissions tracking tools? What do you think needs to happen in this market? How soon will we actually get accurate data? Let us know your thoughts at the Feedback button below.

TheGreenSupplyChain.com is now Twittering! Follow us at www.twitter.com/greenscm

|