What is Peak Oil theory?

Before World War II,

Shell oil engineer M. King

Hubbert observed that oil wells/fields have a very predictable output profile, shaped like a bell curve. Annual output increases until half the oil is gone, after which it starts to decline, because the oil at the bottom is harder to get out.

Hubbert used the curve in the 1940s to not only predict output from individual sites, but for the U.S. as a whole. He suggested that U.S. domestic oil output would peak sometime in the 1970s. At the time, he was severely criticized. As it later turned out, he was quite correct. (See Supply Chain Management and the End of Oil.) Most now say US oil production peaked in 1970.

| |

The Green Supply

Chain Says: |

Maxwell believes that after reaching a production plateau that will last 3-5 years, oil production (from traditional sources) will then start to decline. As the plateau is reached, oil prices will begin to rise – perhaps sharply. Maxwell believes that after reaching a production plateau that will last 3-5 years, oil production (from traditional sources) will then start to decline. As the plateau is reached, oil prices will begin to rise – perhaps sharply. |

What Do You Say?

Click Here to Send Us

Your Comments

Click Here to See

Reader Feedback |

|

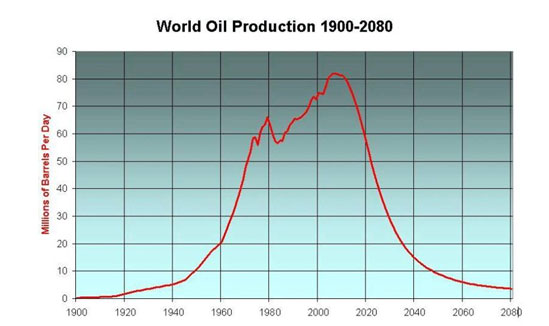

In the 1990s, others looked at this phenomenon on a global basis. Predictions were made, such as that shown in the graphic below, that traditional world oil production from wells would peak sometime around 2010. With that peak reached, and steadily global demand for oil rising overall as developed economies become more voracious oil users, the stage is set for dramatically rising oil prices, a huge impact on businesses, and perhaps devastating social repercussions.

Of course, concern about Peak Oil and oil prices generally cooled dramatically from the height of the summer 2008 oil price spike, as the global recession pounded down world demand for oil. This is especially true in developed economies, where demand for oil may actually have peaked several years ago, as improved efficiency and other factors have ratcheted down oil and gasoline consumption. For example, aging populations in most developed economies means on average the amount of driving that will be done will drop significantly from when the demographics tilted younger.

Demand for oil in developed nations in fact peaked in 2005, according to a claim by IHS Cambridge Energy Research Associates in a report late last year.

Exxon Mobil Corp. CEO Rex Tillerson said at about the same time that U.S. gasoline demand peaked in 2007.

But will those changes be enough to offset the growth in oil demand from China, India and dozens of other fast growing economies? Likely not – which will drive prices much higher if Peak Oil production levels really are reached soon.

Just last week, energy analyst Charles Maxwell of Weeden & Co. said the globe will reach Peak Oil production sometime between 2015 and 2010.

“The business of peaking is now unusual: there are 30 non-OPEC countries with significant production,” Maxwell wrote recently in a column for BusinessWeek. “Thirteen of these have peaked or are about to peak, and they contribute some 52% of the oil volume outside of OPEC.”

Maxwell believes that after reaching a production plateau that will last 3-5 years, oil production (from traditional sources) will then start to decline. As the plateau is reached, oil prices will begin to rise – perhaps sharply – as people and economies become worried, and speculators smell opportunity. But this time, as least, that speculation will be very much be based on real dynamics of supply and demand.

As a result, Maxwell believes we will get to about $150 per barrel again by 2015 – just fours years or so from now – and reach $300 per barrel by the end of the decade.

Maxwell notes there are other sources for oil, such as the Canadian tar sands, that may help alleviate the impact of Peal Oil for awhile, but these sources are unlikely to change the overall course of supply and prices much.

Should we be worried about Peak Oil? Do you think it we will reach that level by as early as 2015? What can companies be doing now to prepare? Let us know your thoughts at the Feedback button below.

TheGreenSupplyChain.com is now Twittering! Follow us at www.twitter.com/greenscm

|