| |

The Green Supply

Chain Says: |

The combination of government led and backed intent to develop clean energies and the near monopoly the country has on key rare earth metals could lead China to a strong advantage in clean energy technology development. The combination of government led and backed intent to develop clean energies and the near monopoly the country has on key rare earth metals could lead China to a strong advantage in clean energy technology development. |

What Do You Say?

Click Here to Send Us

Your Comments

Click Here to See

Reader Feedback |

|

The global warming debate often has two main vectors: the belief by many that greenhouse gases are leading to a perhaps devastating level of climate change, and second that addressing this risk not only will reduce the prospects for global warming but also create new clean energy industries and products and ultimately millions of new jobs.

The latter vision is often in the context that these technologies will be developed and products built in the US and other developed economies, and be not only used in home markets but exported to the rest of the globe.

There’s just one glitch – as always today, it’s necessary to keep a close eye on China.

It’s not well known, but China just recently passed the US as the number one global consumer of energy, a title the US has held since records started being kept decades ago. While the US still far surpasses China in energy consumption per capita, various energy conservation and efficiency efforts have actually led to a total decline in energy usage here in recent years, while China’s sheer population mass and rapid economic growth always meant it would someday be the world’s largest energy consumer.

That puts the Chinese government in a delicate position. It really can no longer fall back on the “we’re a developing economy” defense for its level of greenhouse gas emissions and other environmental issues.

At the same time, it has a social contract of sorts with the citizens of China that the strong level of economic growth will continue – and that will mean ever growing levels of energy consumption.

Hence, the Chinese must also be very aggressive developers of green energy technology and mandates – probably less from a global warming perspective or at least appearance of concern, but from the political and economic realities the country faces moving forward. It must reduce its energy costs.

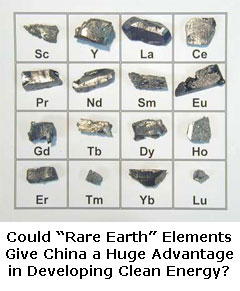

One wild card that is extremely fortunate for the Chinese is the contry's dominance in the so-called “rare earth” metals (e.g., scandium, yttrium) that are widely used in clean energy products. China has been accused or hoarding these metals and limiting their export to other nations – and move that could significantly reduce the ability of the US and other countries to develop some green energy products, and has led to calls for the US to aggressively restart its domestic rare earth development efforts.

The combination of government led and backed intent to develop clean energies and the near monopoly the country has on key rare earth metals could lead China to a strong advantage in clean energy technology development, says Paul Denlinger, a consultant writing on Forbes.com.

“With patents on the new technology used in manufacturing, China would control the intellectual property and licensing on the products that would be used all over the world,” Denlinger writes. “If Beijing is able to do this, it would control the next generation of energy products used by the world for the next century.” “With patents on the new technology used in manufacturing, China would control the intellectual property and licensing on the products that would be used all over the world,” Denlinger writes. “If Beijing is able to do this, it would control the next generation of energy products used by the world for the next century.”

This, he says, is exactly China’s plan.

“It would be like if the oil-producing nations in the 1920s and 1930s said that they didn’t need Western oil exploration firms and refineries to distribute oil products; they would do all the processing themselves, and the Western countries would just order the finished oil products from them,” Denlinger adds. “This is how China obviously plans to keep most of the value-added profits within China’s borders.”

He says that in fact, China consistently signals that this is its intent to foreign companies and countries.

“Unfortunately, these warnings [around rare earth metals] have gone largely unheeded and ignored by the Western media and politicians who, it seems, have been largely preoccupied by multiple financial crises and what to do about the West’s debt load,” Denlinger writes.

He also says that the risky technology and market case for green technologies in the West has made it difficult for many ideas to get funding. That has left a door open for China to move rapidly into development with government funding. But how aggressively they will do this is the open question, as the government recognizes that the green energy solutions must be competitive with existing oil, gas, coal and existing fuels to be viable in the market.

Of course, that line of thinking implies that the Chinese government would be better at picking clean energy winners and losers than the free market. Or perhaps, they will pick enough options to fund and hope some of them work out, still in the end getting their faster than developed markets.

But the West’s risks in terms of rare earth metals and allowing China to control clean energy technology progress are something that governments and business must more adequately address.

Do you think China will be the leader in clean energy development? How big a risk is this rare earth metals issue? What if anything should be done in the US and Europe? Let us know your thoughts at the Feedback button below.

TheGreenSupplyChain.com is now Twittering! Follow us at www.twitter.com/greenscm

|