The Carbon Disclosure Project (CDP) recently released its fifth annual supply chain report, based on surveys of the suppliers to its 50-some member companies, which include Dell, The Coca-Cola Company, Walmart, Ford and more.

Slightly more than 50% of member companies have their headquarters in Europe, slightly less than those in the US, with much smaller numbers of members from South America and Asia.

The supply chain branch of CDP was launched in 2009 as an adjunct to the original CDP, in which companies release their own carbon emissions data and progress. In the supply chain program, the CDP surveys suppliers around similar information on behalf of the member companies.

Participation has certainly continued to grow. In the inaugural survey for 2009, 715 suppliers participated. In the 2013 report based on 2012 date, 2415 surveys were completed, a 30% increase over 2011 and up more than 200% since 2009.

This year's report, developed in partnership with Accenture, lists five key findings from the data:

1. Supply chain risks from climate change are viewed as greater than ever: 70% of the respondents this year identify a current or future risk related to climate change with a potential to significantly affect its business or revenue, the report says.

Respondents see precipitation and temperature extremes, droughts, weather events (hurricanes, typhoons), and the rise in sea levels as having major cost implications from supply chain disruption.

The report especially focuses especially on water-related risks (drought, flooding and water scarcity), with member companies in a related survey saying just 9.5% of their suppliers where applicable are "fully engaged" relative to water risks.

The report also calls out Johnson & Johnson for its efforts in mitigating water-related risks around the world, saying the company did a world-wide analysis of its potential water-risk exposure and then "actively worked to reduce its risk by decreasing water consumption and implementing robust risk management programs."

However, we wish the report had provided some data about results in this area from previous studies to understand if perspectives are changing.

2. A persistent performance gap exists between CDP supply chain members and their suppliers: As an example of this gap, the report says that 92% of members report having a target for emissions reductions compared with only 38% of suppliers.

However, that gap should not be surprising, as by their membership in the CDP supply chain group, those companies by definition are more strongly engaged in the issue versus the average company. In addition, the sponsors are heavily weighted towards the consumer goods sector, where consumer perceptions clearly drive some of the interest in sustainability, whereas their suppliers are often a level or two below the consumer and thus in some cases less sensitive to consumer perceptions.

More interesting from our view is that the report found that the percentage of suppliers investing in emission reduction initiatives has remained at 27% for several years, while the percentage of CDP Supply Chain members that reported making such investments has jumped from 39% in 2011 to 69% in 2012.

Similarly, 63% of members report year-on-year emissions reductions, while only 29% of suppliers reported such an achievement.

What to do about this? The report recommends improved oversight and use of more incentives and penalties.

Interesting for sure was the approach taken by Imperial Tobacco, which the report quotes as saying "When suppliers ask for price increases due to energy costs, we first turn to their CDP reporting history. We require reporting on energy and climate risk management before granting these increases unless there are exceptional circumstances."

3. Leading companies are investing and making a difference: The report says that of the 678 companies investing in emission reductions initiatives, 73% say they feel that climate change presents a real physical risk to their operations, with just 13% saying regulation was the main driver of risk to their business.

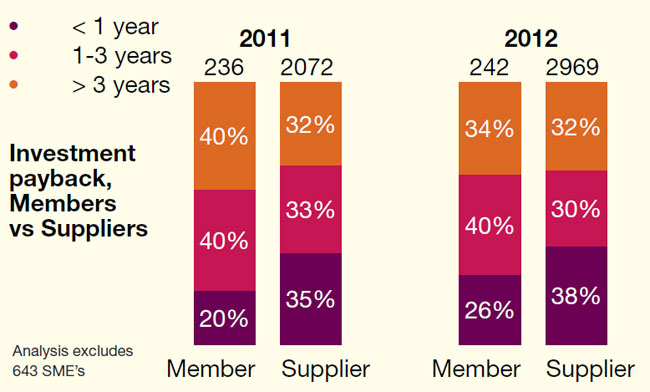

The report also says the returns from such investments appear to be increasing. The percentage of initiatives with a short payback period of one year or less, for example, has increased from 20% in 2011 to 26% in 2012, according to this data.

A chart showing the payback periods of climate-related investments for both CDP supply chain members and their suppliers is provided below.

Time Periods for Payback on Climate-Related Investments

2013 Climate Disclosure Project Supply Chain Report

Interestingly, by far the project area with the largest short term paybacks for both members and suppliers were those related to "behavioral change" by employees.

4. Supply chain sustainability is creating multiple forms of business value: New, low-carbon products are seen by respondents as a major driver of future growth, the report says.

It calls out Dow Chemical, for example, which has said that it sees enormous opportunity for growth through more sustainable products, stating recently that it believes that it can grow sales of clean-energy enabling products from $5 billion per year currently to $15 billion.

The data showed that 10% of participating CDP supply chain members report that they are receiving more than 50% of their revenues from low-carbon products. That seems hard to believe, and we suspect it has to do with how companies define "low carbon products."

16% report they are receiving at least 10% of revenues from such products, and that in five years, the percent of companies that have at least 10% of revenue from green products will grow from 17% this year to 23%.

And of course, the report says going more Green can have a very favorable impact on a company's brand image and therefore business value. Respondents called out almost 500 separate ways that improving brand perception by being a sustainability leader can drive improved bottom line performance, ranging from the ability to maintain a price premium to attracting better talent into the organization.

5. To achieve a leadership position in supply chain sustainability, companies should have strong capabilities in data, process and governance: Having the right data and metrics is key to success, the report says, and it's hard to argue with that.

However, the report says, "Although many progressive companies have basic data collection systems in place, these systems are not necessarily helping the supply chain organization to set and improve emission reductions targets."

It calls for more use of Green supplier scorecards, sustainability information as part of RFPs, clear goal and target setting and more.

With regard to processes, companies need to "embed policies, procedures and codes of conduct into everyday operations," the report says.

Sustainability should not be something separate from normal processes, it should just be the “way things work,” the report says.

"Supply chain innovators have an enormous opportunity to improve environmental sustainability on a global basis, while also increasing the value of their own companies," the report also notes in conclusion.

The full report is available here: CDP 2013 Supply Chain Report

Any reaction to the 2013 CDP Supply Chain report? Let us know your thoughts at the Feedback button below.

|